Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

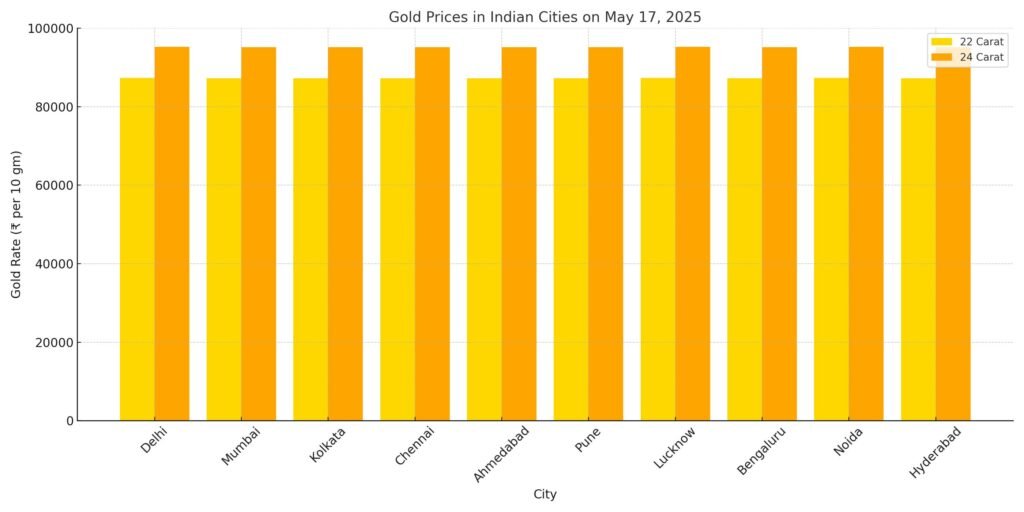

Gold, one of India’s most trusted forms of investment, is seeing a sharp price correction this week. After touching a historic high of ₹1 lakh per 10 grams earlier this year, gold prices have now dropped by almost ₹5,000, settling around ₹95,000 per 10 grams on May 17. This marks the second day of decline in a row and is catching the attention of both investors and general buyers across the country.

| City | 22 Carat Gold (₹/10gm) | 24 Carat Gold (₹/10gm) |

|---|---|---|

| Delhi | ₹87,360 | ₹95,290 |

| Mumbai | ₹87,210 | ₹95,140 |

| Kolkata | ₹87,210 | ₹95,140 |

| Chennai | ₹87,210 | ₹95,140 |

| Ahmedabad | ₹87,260 | ₹95,190 |

| Pune | ₹87,210 | ₹95,140 |

| Lucknow | ₹87,310 | ₹95,290 |

| Bengaluru | ₹87,210 | ₹95,140 |

| Noida | ₹87,360 | ₹95,290 |

| Hyderabad | ₹87,210 | ₹95,140 |

Internationally too, the yellow metal is following the same path. After peaking near $3,500 an ounce in April, it now trades around $3,140. Experts say the reason for this fall is that global tensions, especially trade-related issues, are cooling down. As the fear in global markets eases, people are moving away from gold, which is traditionally seen as a “safe-haven” investment during uncertain times.

Yogesh Singhal, Chairman of the All Bullion and Jewellers Association, told India TV, “We’ve seen this kind of correction before. Back in 2013, global gold prices dropped heavily, and something similar could happen now if conditions turn the same.” He added that if the international price slips further from $3,230 to around $1,820 an ounce, Indian gold rates could fall even more, possibly dropping to ₹55,000–₹60,000 per 10 grams.

Today, gold rates across Indian cities are reflecting this correction. In Delhi and Noida, the price for 24-carat gold is around ₹95,290 per 10 grams, while in cities like Mumbai, Kolkata, and Chennai, it is roughly ₹95,140. The rate for 22-carat gold in most major cities like Bengaluru, Hyderabad, Ahmedabad, and Pune stands close to ₹87,210 to ₹87,360 per 10 grams.

The reason why gold prices keep going up and down is not always simple. It depends on many things — how much gold the world wants, how strong or weak the Indian rupee is, what interest rates are being offered in the market, and even rules and taxes set by the government. On top of that, global news, economic health, and the strength of the US dollar all have an impact on what Indians pay for gold.

While this fall in prices may worry short-term investors, many financial advisors still believe gold is a solid long-term asset. It may not give high returns immediately, but its value in uncertain times and its cultural importance in India make it a favourite that rarely goes out of style.

At The Orbit Live, we’ve been reporting economic shifts since 1949, and one thing we know for sure — gold always finds its way back. Whether you’re buying for weddings, investing for the future, or simply adding to your savings, timing matters — but so does patience.

Now the big question is — with prices falling, will you wait for a deeper dip or grab the opportunity while it’s still shiny?

What do you think — is this the right time to invest in gold, or will you wait and watch? Let us know your view.